AI-Powered Dynamic Pricing: A Complete Guide

Dynamic pricing isn’t a new concept. For decades, consumers have been accustomed to demand-driven price changes in industries such as air travel and hospitality. In the last few decades “surge pricing” has become a new part of our collective vernacular with the advent of ride-sharing apps. Today it’s no surprise for consumers to see price fluctuations in their online shopping carts, as retailers raise and lower prices on a daily (or hourly) basis.

In an ever-shifting market landscape where consumer demand ebbs and flows, dynamic pricing can be a useful tool (when implemented properly) to remain competitive and more profitable. Dynamic pricing can be an effective tool for leveraging increased demand to balance out slow periods and recoup from other unexpected market expenses and losses.

What is Dynamic Pricing?

Dynamic pricing, also known as real-time pricing, is an automated pricing strategy businesses use to capitalize on especially high demand periods. It involves setting flexible prices for products or services based on current market activity. It’s one of many pricing strategies that a brand can deploy, but has increasingly become a popular choice of more and more brands. Other tactics employed in dynamic pricing include:

- Competitor pricing

- Price skimming

- Markdown pricing

- Penetration pricing

- Variable pricing

- Product bundling

While these tactics are widely used, demand pricing stands as a particularly effective strategy because of its reliance on real-time data to trigger changes and capitalize on price increases for in demand or high interest products to exponentially drive revenue.

How Does Dynamic Pricing Work?

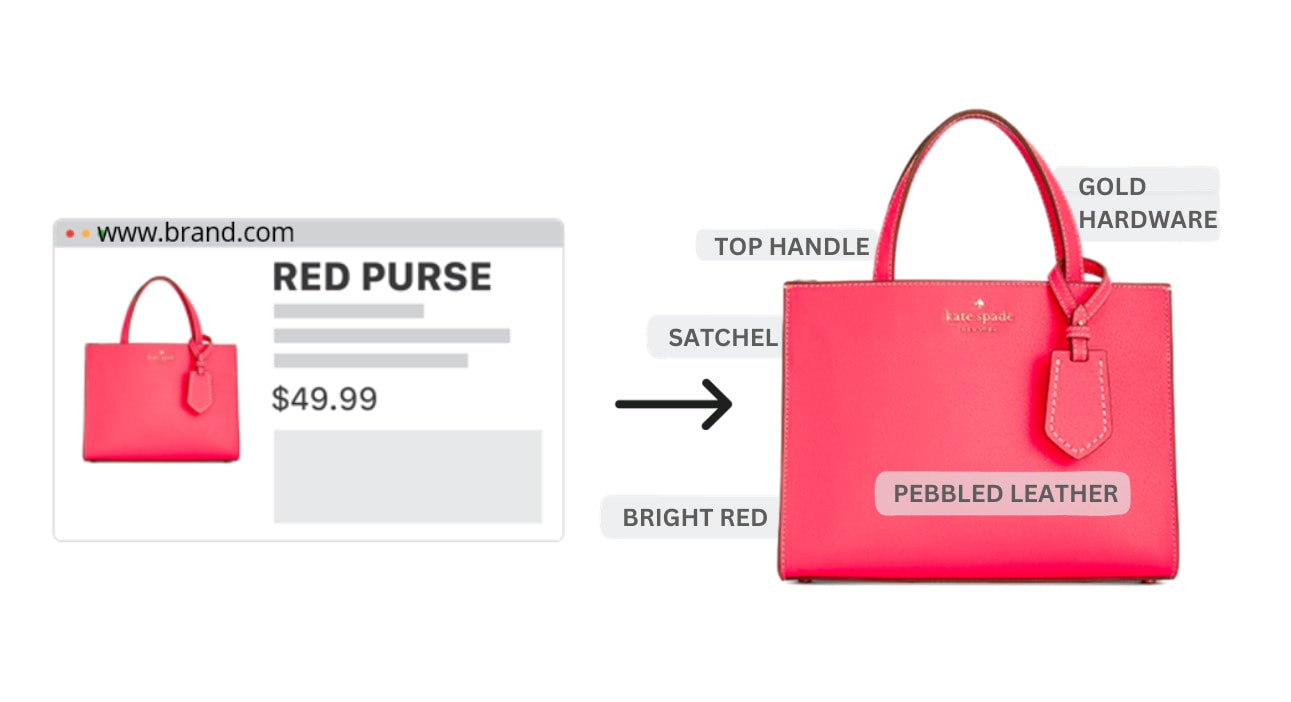

Dynamic pricing for retailers is a pricing strategy that hinges on several core elements, which must be continuously monitored and properly adjusted to reflect current market conditions. Several key elements play a pivotal role in the dynamic pricing mechanism:

It’s crucial to understand the characteristics that define each product’s value prop. Specifics such as quality, brand, scarcity, and even the speed at which a product becomes obsolete all factor into price changes. The uniqueness of a product, or its appeal during a specific season or event, can significantly influence its price elasticity. For instance, a limited-edition item may command a higher price because of its perceived exclusivity (like a Super Bowl winner’s commemorative T-shirt), or a sustainable item using recycled material might also command a higher price, while a basic commodity (plain white t’s) might have far less urgency and demand.

Retailers must also navigate through a sea of financial data to make informed pricing decisions. This includes the cost of goods sold (COGS), operational expenses, and desired profit margins. A retailer’s pricing strategy will need to consider these financial data points to ensure profitability while remaining competitive. When prices are adjusted in real time to respond to these financial performance indicators, it ensures the company meets its financial targets.

Inventory levels act as a barometer for pricing adjustments. High inventory levels of a particular product may trigger a price decrease to accelerate sales and free up storage space. Conversely, low inventory levels, especially for in-demand items, can bear the opportunity for price increases. The goal is to maintain a harmonious flow of goods—too much stock can eat into profits, while too little can lead to lost sales.

Retailers face waves of seasonal changes that can dramatically affect pricing strategies. Seasonal demand, clearance cycles, and even cultural events can dictate the timing and degree of price adjustments. For example, winter coats are likely to be priced higher during the cold months and discounted at the season’s end to clear space for spring inventory.

Geographical nuances play a significant role in pricing. What sells in one region at a premium might require a different pricing approach in another due to varying levels of local demand, economic conditions, and purchasing power. Dynamic pricing allows retailers to adjust prices at a regional level to optimize sales and profits.

In the world of retail, prices aren’t set in isolation. Competitors’ pricing strategies can provide crucial benchmarks. By continuously scanning the competitive landscape, retailers can ensure their pricing is aligned with market expectations. If a competitor drops the price for a similar product, a retailer may need to respond with a price adjustment to maintain its market position.

In essence, dynamic pricing is like steering a ship through ever-changing seas. Retailers must adjust their sails (their prices) in response to the winds of product attributes, the tides of financial data, and the currents of inventory levels, all while navigating the broader climate of market variables. This approach requires a focus on analytics and an automated process for responding to changes when they are identified.

What is the Difference Between Variable Pricing and Dynamic Pricing?

Variable pricing often gets confused with dynamic pricing. But while they’re both beneficial parts of a pricing strategy, understanding how they differ can help determine the best option for a given market. Unlike dynamic pricing, variable pricing alters pricing based on market demand. It’s a more static approach that doesn’t change instantaneously but adjusts over time as demand patterns emerge and retreat. For example, a retailer might set different price points for the same product across various seasons or even days of the week, based on historical demand data. The adjustments are pre-planned and based on anticipated shifts in consumer interest and willingness to pay.

Dynamic pricing, on the other hand, is a real-time strategy that involves instantaneous price adjustments in response to immediate market conditions. This can include changes in competitor pricing, shifts in supply and demand, or sudden market trends. It’s an agile and proactive pricing strategy that allows retailers to respond instantly to the market’s pulse. If a competitor unexpectedly slashes prices or if a sudden surge in demand occurs due to an unforeseen event, dynamic pricing enables a retailer to adjust prices on the fly to capitalize on the situation or mitigate risks. The key difference lies in the speed and triggers for price changes. Variable pricing moves to the beat of a forecasted demand drum, while dynamic pricing dances to the live rhythm of the market, with the capability to change prices at a moment’s notice, reflecting the immediate state of the marketplace.

What is Price Elasticity of Demand?

Price elasticity of demand is a metric used by retailers to measure how sensitive the quantity demanded of a good or service is to a change in its price. This formula quantifies the responsiveness, or elasticity, of consumers’ buying behavior in purchasing more or less of a product based on price increases or decreases. The equation for calculating price elasticity of demand is:

Price elasticity of demand (PED) = percentage change in quantity demanded / percentage change in price

In practical terms, this can result in the following findings:

- If the PED is greater than 1, the demand is determined to be elastic, meaning the quantity demanded changes by a larger percentage than the price does. Consumers are quite responsive to price changes in this scenario.

- However, if the PED is less than 1, the demand is inelastic. The quantity demanded changes by a smaller percentage than the price and consumers are not as responsive to price changes.

- If the PED equals 1, the demand is unit elastic. The percentage change in quantity demanded is exactly the same as the percentage change in price.

Price sensitivity, as measured by this elasticity, is crucial for retailers to understand because it informs them about potential changes in sales volumes as a result of price changes. For instance, if a retailer knows that a product has high price elasticity, a small decrease in price could lead to a significant increase in the quantity sold, potentially increasing overall revenue. Conversely, for goods with inelastic demand, prices can rise without significantly decreasing the quantity sold, which could also lead to higher revenue.

Understanding this concept can help retailers make informed decisions on pricing strategies, sales promotions, and inventory management, ensuring they align their pricing with consumer behavior and market realities.

How Pricing Can Influence Demand

Dynamic pricing isn’t just about numbers; it’s about behavior. By adjusting prices, even slightly, for slower-selling items, businesses can stimulate demand, ensuring that products don’t languish on shelves. But it’s not just lowering prices that can have a desirable effect.

Higher prices can create a perceived higher value as well. Rafi Mohammed writes about the ripple effects of Bruce Springsteen’s concert ticket pricing approach in “7 Lessons on Dynamic Pricing” at Harvard Business Review where he cautions that “low prices can devalue a product.” From concert tickets to sneaker sales, there are many examples of where dynamic price increases have garnered attention and interest from buyers in a reverse of the “lower is always better” mindset.

What are the Benefits of a Dynamic Pricing Strategy?

Employing a dynamic pricing strategy comes with a variety of revenue-bolstering advantages:

- Enhanced pricing control: Dynamic pricing empowers businesses with the ability to fine-tune prices with greater precision, ensuring competitiveness while safeguarding margins.

- Brand value management: Implement price adjustments that reflect market conditions without undermining the perceived value of the brand.

- Sustainable profitability: Leverage dynamic pricing to foster a pricing ecosystem that supports long-term financial health and growth.

- Demand stimulation: This pricing strategy can boost the appeal and movement of slower-selling inventory.

- Rapid market adaptation: Speed has become a necessary quality in retail spaces and dynamic pricing can help ensure swift responsiveness to market fluctuations, keeping pace with or outpacing competitors’ actions.

- Strategic competitive advantage: Gain a strategic foothold in the market by continuously aligning with market trends, and competitors pricing and discounting strategy.

- Streamlined pricing operations: Dynamic pricing software allows retailers to automate and optimize pricing decisions, while minimizing manual intervention.

- Data-driven price optimization: Leveraging advanced analytics and AI pricing which can automatically take a number of influencing factors into consideration to make pricing decisions with greater accuracy.

- Optimized inventory turnover: Utilize dynamic pricing strategies to assist with the timely clearance of end-of-life product inventory, reducing the risk of obsolescence and write-offs.

Are there Disadvantages to Dynamic Pricing?

While dynamic pricing might hold great revenue-generating potential, there are some risks that go along with such high-stakes rewards. It’s important to be aware of these obstacles so steps can be taken to protect a brand’s reputation and customer loyalty from being damaged by these challenges.

First, customer satisfaction may be tested by the constant fluctuation of prices, which can create a perception of unpredictability and capriciousness. Lowering pricing runs the risk of customers hesitating to buy if a discounted price may be just around the bend. This however can work both ways and customers may be more prone to checkout before a price increase occurs.

Since this pricing strategy’s success hinges on the availability of precise, high-quality data, it’s important not to begin any dynamic pricing without the support of highly-accurate pricing intelligence support. The advent of AI technology has allowed this type of price optimization to become feasible. But while technology has fostered greater pricing flexibility, ethical considerations must not be overshadowed by these greater capabilities. Businesses who venture into dynamic pricing will need to be wary to avoid exploiting market fluctuations in a way that could be perceived as opportunistic, such as during severe weather or other localized crises.

How Can Companies Implement Dynamic Pricing Models?

Investing in a predictive pricing solution is the first step in being able to utilize dynamic pricing, but not all solutions are created equal. Rule-based pricing solutions for example cannot take business constraints into account – this could be the refurbishment of a shop, a particular event or storage capacity. When investing in AI pricing, ensure that it can:

- Determine business objectives: The system must be able to optimize for key business metrics so teams can set clear, measurable goals to align the dynamic pricing approach with the company’s overall business strategy.

- Track competitors’ prices: Can the system optimize pricing based on what competitors are doing in the market, this is key in being able to maintain a competitive edge.

- Automate price changes with transparency: Most solutions do not offer transparency into pricing recommendations nor allow the user to compare predicted outcomes. You want the solution to be able to make pricing recommendations to assist your decision making.

- Test and trust your dynamic pricing strategy: It can be difficult for teams to fully trust AI, it’s important to have a solution that automates the workflow of optimizing pricing where teams can then focus on the exceptions where a rule might need to be broken to achieve the overarching goals of the business.

As the McKinsey piece “Dynamic pricing: Using digital and analytics to take value pricing in the chemical industry to the next level,” points out, “To ensure successful implementation and sustainability of dynamic pricing’s impact, companies must have the appropriate IT and analytics infrastructure and performance-management capabilities.” Without this data support, a business would be hard-pressed to effectively implement dynamic pricing in any informed manner.

How Can Dynamic Pricing Help with Price Optimization?

Dynamic pricing serves as a pivotal tool in price optimization, enabling retailers to refine their pricing strategies across various stages of a product’s lifecycle, from initial pricing to discounts and promotions. By leveraging real-time data analysis, retailers can accurately adjust prices, ensuring they remain attractive to consumers while protecting (and even enhancing) profit margins. This strategy is particularly effective when combined with a deep understanding of customer demographics, which provides insights into purchasing patterns and price sensitivity. With deeper pricing intelligence, retailers can tailor prices not only to market conditions but also to the preferences and behaviors of different customer segments, maximizing revenue and maintaining customer satisfaction.

Dynamic pricing offers retailers a promising opportunity to increase profits on their most in-demand products while more efficiently discounting and nudging sluggish sales. But dynamic pricing depends on accurate, real-time data and powerful AI capabilities, along with an automated system for triggering and putting into place price changes.

Harness the Power of Price Optimization for Strategic Advantage

Centric Pricing & Inventory ™ has the ability to take a large number of influencing factors (too many to take into account on a spreadsheet) and use all this additional data to suggest optimal pricing for the entire pricing lifecycle of every product, in every location and channel.

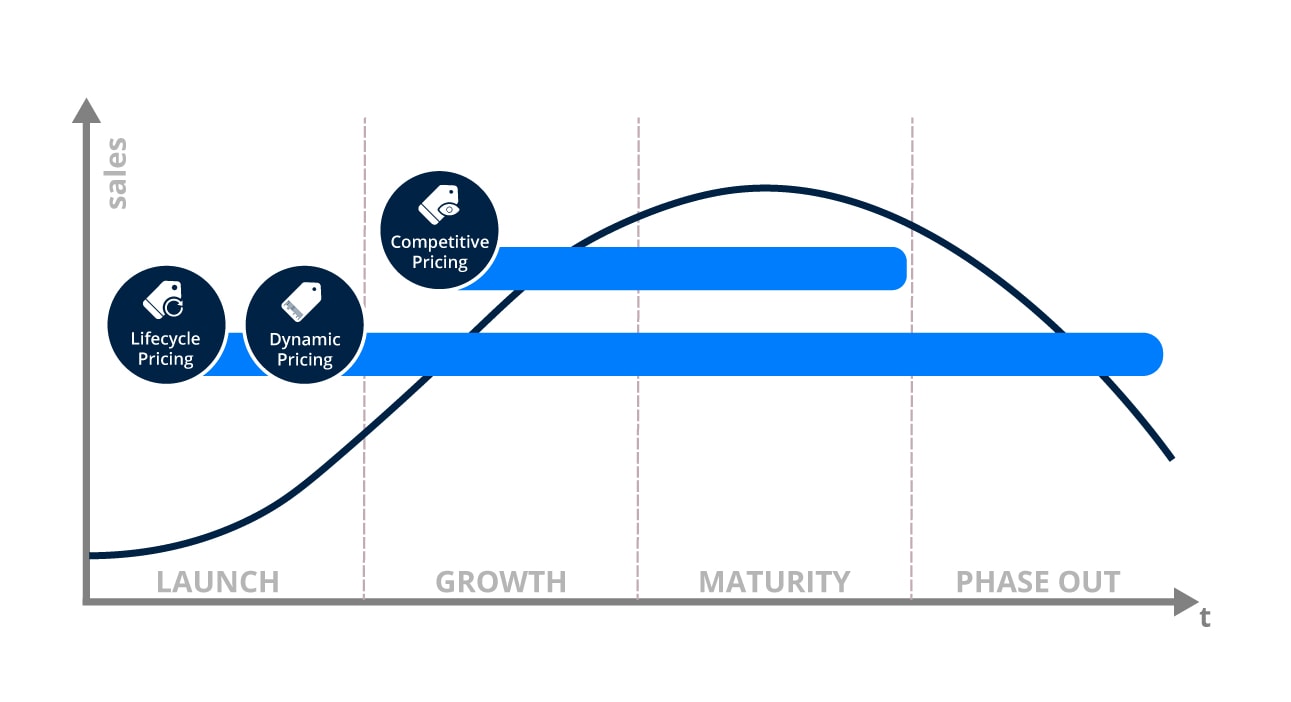

Lifecycle pricing: Calculates the optimal price for market launch for seasonal products as well as the pricing process along the entire product lifecycle, from markups and markdowns to promotions. Aim is to increase sales and ensure more products sell through closer to full price to increase margin.

Dynamic pricing: More relevant for e-commerce infinite stock, those items with no end date to automate real-time price changes for any e-commence product. Aims to improve working capital and increase efficiency through automation.

Competitive pricing: Relevant for key value items and to adjust pricing based on competitor response. Aim is to lower inventory and lower the markdown amount.

Discover this seamless and user-friendly platform to optimize your pricing strategy and empower teams to make better decisions in less time.